Health insurance is a crucial aspect of our lives, offering financial protection against unexpected medical expenses. Navigating the complexities of insurance policies can be overwhelming, particularly when it comes to deductibles and out-of-pocket maximums. In this article, we will shed light on what deductibles are, why they can be high, and why an out-of-pocket maximum exists, helping you gain a better understanding of these concepts and how they impact your healthcare costs.

What is a Deductible?

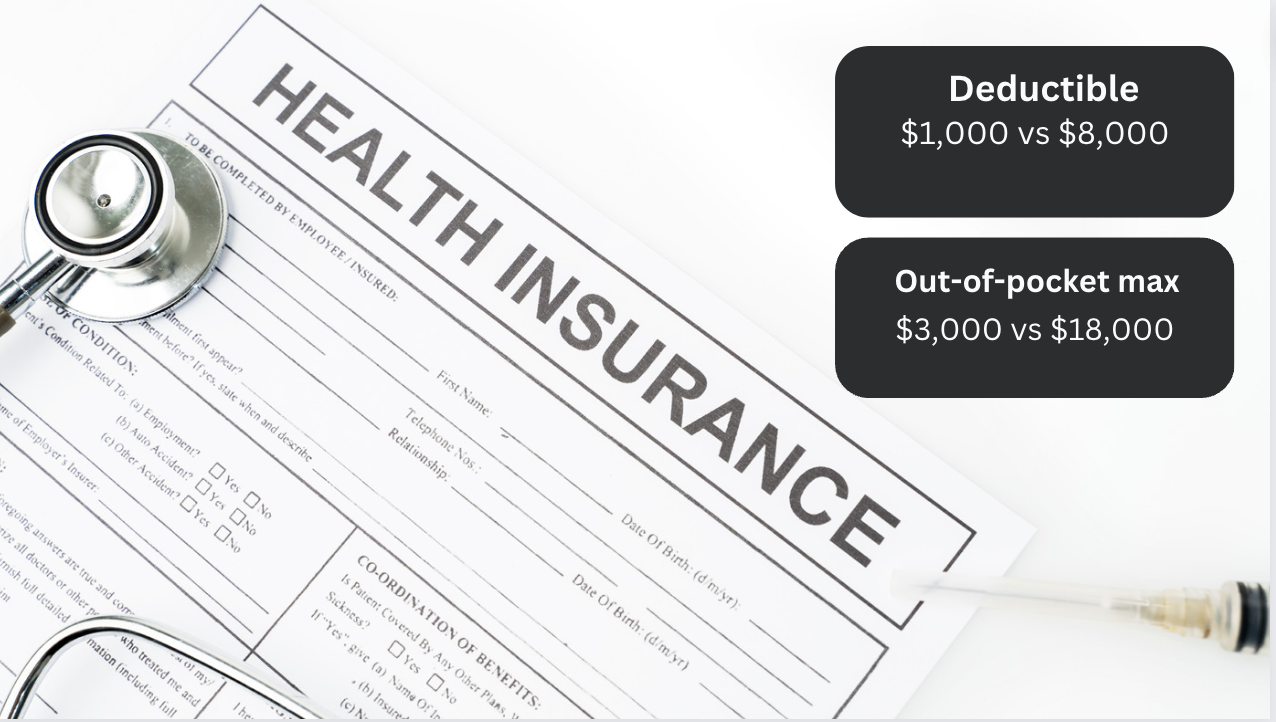

A deductible refers to the amount of money an individual must pay out of their own pocket before their health insurance coverage begins to take effect. It is an annual cost that varies depending on the insurance plan you have chosen. For example, if you have a $7,000 deductible, you must pay the first $7,000 of eligible medical expenses before your insurance starts sharing the costs.

Why are Deductibles Often High?

The primary reason deductibles can be high is to reduce insurance premiums, the regular payments individuals make to maintain their coverage. By setting higher deductibles, insurance companies are able to lower the cost of premiums because they shift a larger portion of the financial burden onto the insured.

You may have a $500 monthly premium and a $7,000 deductible, but if you opt for a $9,000 deductible, your monthly premium may decrease. However, remember that the deductible is the amount you will be responsible for if a medical need occurs. The average self-employed family premium for health insurance is $2,000 a month, and the deductible can range between $6,000 and $16,000 in a calendar year.

Understanding Out-of-Pocket Maximums:

While deductibles may seem like a substantial financial burden, it's important to recognize that they are not the only cost consideration in health insurance. In addition to deductibles, there is an out-of-pocket maximum, which is the maximum amount an individual will have to pay in a given year for covered medical expenses.

The out-of-pocket maximum provides a safeguard against catastrophic medical expenses by limiting the total amount an individual must pay, regardless of deductibles or copayments. Once the out-of-pocket maximum is reached, the insurance company covers all eligible expenses for the remainder of the year, providing much-needed financial relief.

When you reach your deductible, before you take that sigh of relief that you met your max out of pocket, read your plan, if you have a out-of pocket-max-limit you may still have bills to pay. Example: if you broke your leg and had a $5,000 deductible and $10,000 out-of pocket-max-limit. And if your surgeon or any of the providers that examined you were not "in network" that fee may apply under the max-out of pocket. Networks can play a significant role in determining the maximum out-of-pocket (MOOP) limits in health insurance plans. The concept of a network refers to the group of healthcare providers (doctors, hospitals, clinics, etc.) that have agreements with the insurance company to provide services to their policyholders at negotiated rates.

Why is an Out-of-Pocket Maximum Necessary?

While deductibles serve as a cost-sharing mechanism between insurers and insured individuals, an out-of-pocket maximum is crucial to prevent excessive financial burdens and protect policyholders from overwhelming medical expenses. Medical emergencies or prolonged illnesses can result in exorbitant healthcare costs that could be financially crippling without the existence of an out-of-pocket maximum.

By setting a cap on out-of-pocket expenses, insurance companies ensure that individuals are not left financially devastated by unexpected medical bills. It provides peace of mind and reassurance that no matter the extent of medical treatment required, there will be a limit to the amount one has to pay.

Health insurance functions with deductibles and max out-of-pocket limits, which can be confusing when the time comes for you to actually use your policy. 57% of Americans are surprised by a medical bill. You may think you reached your deductible and then find out the doctor on call at the hospital was contracted and not in-network. In this case, you will have a bill that may fall under the max out-of-pocket. Unexpected medical bills can be time-consuming and financially distressing to resolve.

To learn more about indipop and explore their plans, visit www.indipop.co.

Or get a quote in minutes here!